Blogs

Almost every other pros tend to be fewer video game limits and better small print. Note that truth be told there’s an offer providing 70,100 Ultimate Perks when applying in the a Pursue branch. When you yourself have one Pursue cities close by, it would be really worth the effort to utilize thru a great banker so you can earn those individuals 10,000 additional things.

Fees

CardMatch is actually a tool enabling pages to check on to have directed also offers out of banking people. A number of the larger U.S. financial institutions, such as Pursue and you can Western Display, publish such targeted now offers to the CardMatch, revealing those proposes to pages whom use the CardMatch tool. Myself, I’ve a few discounts account that will be carrying money to own the next leasing investment. The newest profile I’m using are at Raisin, UFB Direct (it has the greatest APY already), and see Lender. While i usually suggest individuals disperse their funds to a great family savings to your higher rates, the whole process of “speed chasing after” might be day-ingesting. A notable brighten for the account ‘s the ability to create limitless distributions.

The deal & Key Card Information

- It is possible to secure a massive 4X items for the all the Take a trip groups if the you happen to be a great PenFed Remembers Virtue Affiliate, if not it’s 3x items.

- To decide and therefore user checking accounts supply the best place to help you put your money and you may earn a bonus, CNBC Find reviewed dozens of U.S. examining profile supplied by the largest national banking companies and you will borrowing unions.

- However it’s really worth taking a look at, especially because it’s totally free plus credit doesn’t rating drawn.

- This type of terms make it CreditCards.com to use your user report advice, and credit rating, to own internal team motives, such as raising the web site feel and to business almost every other issues and you will characteristics for your requirements.

- All of the viewpoints conveyed here are member generated as well as the views aren’t given, examined otherwise recommended from the any advertiser or DansDeals.

Normal and you will the website Marketing and advertising Interest levels will get changes any time as opposed to previous notice. The new special yearly interest is computed daily and you will paid back month-to-month. Sure, both Zero Fee Chequing Membership and you will Highest Focus Checking account also provides are only accessible to clients.

- But more about financial institutions allow it to be worthwhile by the offering new clients an advantage after they unlock an account and you may fulfill certain requirements.

- In addition to high game and great gambling, with your smart phone – cellular phone otherwise pill – you get a similar no-deposit subscribe added bonus for cellular at the Grande Vegas Local casino Australian continent.

- One of the recommended advantages from checking a Chase Independence Unlimited bank card is actually its current welcome offer.

For individuals who’re already starting a different account, it doesn’t take long to locate also provides and you will examine a few sign-right up incentives to determine what ones you could potentially qualify for. Put at the least $a hundred 30 days to own 12 straight months in order to qualify for the new added bonus. After 12 months, you need to take care of a balance of at least $step 1,200 to earn the bonus. For those who meet those standards, Alliant tend to disburse the brand new $100 extra within this per month. The brand new Alliant savings account extra provide is best for individuals who really wants to introduce a romance that have a cards relationship and you can are accumulating their savings inside the shorter increments.

SoFi Examining and you can Offers Extra Sections

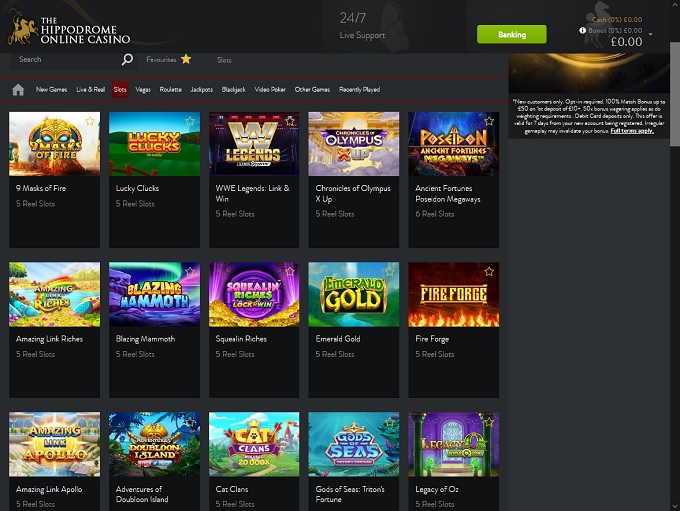

Extremely incentives try instantly given for your requirements after you signal up playing with readily available no deposit added bonus codes. In some cases, the new free added bonus code will come in the type of an association, that can instantly activate the fresh no-deposit incentives. Here you can find the fresh no-deposit incentive promos and this were a hundred free revolves no-deposit also provides. Concurrently, specific brands provides big advice software, that enable current people to get up to $1,one hundred thousand. Taking advantage of the fresh referral no-deposit gambling establishment bonuses is a good great options if you wish to enjoy table game and other options available in the game alternatives.

We list all the biggest alternative offers on the better online casinos found in the area. The fresh CSP might have been parked during the 60,one hundred thousand things to possess awhile today, it’s nice to see some thing sweetening upwards a while. So it isn’t competitive with the newest 80-85K also offers that we saw earlier this season, however it’s nonetheless a $95 cards which have a primary-12 months value of more than $1,100 according to our very own Best Also offers page. We along with favor cards having incentives that feature almost every other perks otherwise numerous perks levels, increasing the versatility of the credit outside the incentive. Whether or not bonuses are created to make you spend, usually do not purchase in manners your usually would not for the sake of a bonus. If you need to purchase additional your own methods to come to they, it’s no extended a bonus, particularly if you are unable to repay a complete equilibrium and you may dish up attention charges.

Most recent Financial from The usa Discounts & Incentive Also provides

Rates of interest to the Precious metal Savings account is adjustable and subject to alter any moment without notice. Earn around $500 once you unlock another Chase Company Over Checking account. For new Pursue team examining people with qualifying items. All of the cardholders can be earn to $50 a year within the report loans when scheduling a hotel stand thanks to Chase Traveling. After finding your credit, you must make a minimum qualifying invest with a minimum of S$800 within this 60 days away from approval. The newest editorial content in this article is based exclusively on the mission, independent tests by the our very own writers which is maybe not influenced by adverts or partnerships.

Chasing a pleasant extra that have increased investing requirements may lead in order to overspending, higher borrowing from the bank use and you can personal debt, if not mindful. Whether you’re having fun with a business charge card otherwise individual mastercard will even play a role. Organization cards could possibly offer more productive signal-right up incentives, nevertheless they usually also provide large spending thresholds than simply individual notes. Choosing the best mastercard acceptance incentive relates to a great handful of different aspects — just how large the fresh using needs are, how it is possible to receive they and you can whether or not you should spend a yearly commission to have it.